CEO Q&A at Energy Mines and Money Conference (part 2)

Cameron Vorias, Managing Director & CEO of Sojitz Coal Mining and our Managing Director, Chad Gates, were invited to a CEO Q&A session at Energy Mines and Money Australia Exhibition and Conference in June 2019. Here are excerpts from their discussion.

Read part one of this blog that provides an introduction to Cameron and Sojitz Coal Mining.

Chad

As CEOs we know that any change and growth comes with risk. Can you tell me about the risk profiling for a project such as this, from your prospective?

Cameron

It’s always a risk. We’ve been able to bring this mine site into production quite quickly to take advantage of where the coking coal price is at the moment. For a business like ours with multiple sites, particularly two thermal coal sites, there are challenges you need to consider and are difficult to predict. There are also factors for everyone in mining that are a challenge, political change for example.

I think one of the key lessons we got out of the downturn is the importance of building a resilient business – and drive your costs down. The Meteor Downs South Mines for example will be 30,000 tonne per man mine site, so it can be recession proof. Gregory Crinum Mine supplies a high quality coking coal into markets such as India, China and Japan, which will always be in demand.

Another strength is managing our existing assets – and potentially building another two operations in the next six to 12 months. That’s rapid growth which requires attracting the right talent, in what is a very dynamic human resource environment.

A big factor for success is culture and this is where Sojitz is different. As a management team, we’re very hands on, we’re very much at the coal face and we’re very lean in terms of corporate overhead. We value strong and sustainable business relationships where both parties can rely on and support each other into the future.

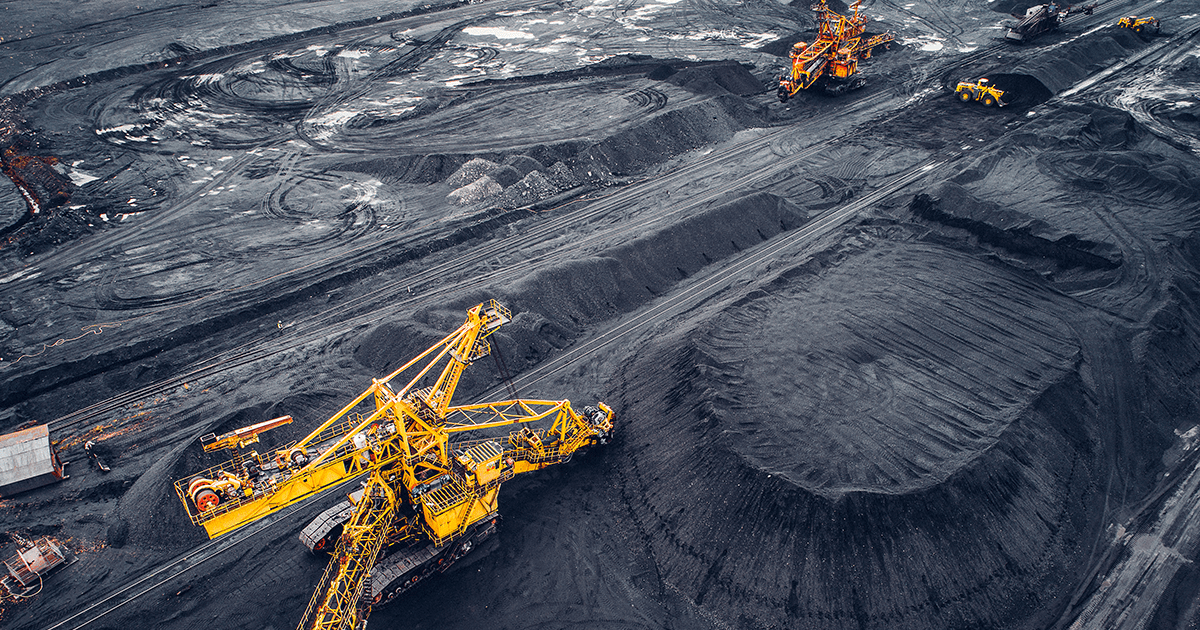

For us it’s about being cutting edge and driving our costs as low as we can and using information – taking on-board powerful technology. We’re really driving hard with semi-autonomous dozing and drilling – and we were one of the first to use drone technology around the Bowen Basin. We’ve created a technology division in our organisation to look at what’s next around autonomous and semi-autonomous equipment.

Chad

How about software? Particularly interested Cameron, with how your business is managing growth, you’ve got these new properties coming on board, all this equipment. How does the technology help you drive that?

Cameron

When you’re managing just one mine business, your management team is focused on that one mine and you can drive your level of detail, looking at your cost structures for example. When you become four or five mine sites, the culture changes and you need reliable and powerful software to manage your information. This is because you need to be looking at your information in a more responsive manner – decisions need to be quicker to drive the change that’s required to achieve success.

Gregory Crinum Mine for example, is a mine at 14:1 strip ratio, you’ve got to be on top of your cost. The reason why we ultimately chose Pronto Xi – it is a well-established, good piece of software with an outstanding reputation in asset management. We went through the full analysis and even against the other ERP solution we had at that site, Pronto Xi provided strong value.

Read part three of this blog to learn how Cameron’s thoughts on the challenge of standardisation and predictive maintenance.

Let's stay connected

Be the first to receive our resources, including news about your industry.